Introduction:

bitcoin etf competition defis credit boom 92cf40232bff, The world of cryptocurrency is evolving rapidly, and one of the latest developments capturing the attention of both investors and enthusiasts is the competition among Bitcoin Exchange-Traded Funds (ETFs). This article explores the dynamics of this competition and delves into its potential consequences, particularly in the context of decentralized finance (DeFi) and the ongoing credit boom.

Bitcoin ETFs: A Brief Overview:

Bitcoin ETFs represent a financial instrument that allows investors to gain exposure to the price movements of Bitcoin without directly owning the cryptocurrency. These ETFs have become a focal point for traditional investors seeking a regulated and convenient way to include Bitcoin in their portfolios. The competition among different ETF providers has intensified, with each vying for a share of the rapidly growing cryptocurrency market.

Must Read=Jim Jefferies Biography, Wife, Net Worth, Age

Key Players in the Bitcoin ETF Race:

Several financial institutions and investment firms have entered the Bitcoin ETF arena, contributing to increased competition. Notable names such as Grayscale, VanEck, and Purpose Investments have sought regulatory approval for their Bitcoin ETFs, each presenting unique propositions to attract investors. The variety of offerings in terms of fee structures, custody solutions, and trading mechanisms adds complexity to the decision-making process for potential investors.

Impact on Traditional Financial Markets:

The approval and widespread adoption of Bitcoin ETFs can have a profound impact on traditional financial markets. As institutional investors gain easier access to Bitcoin through these regulated investment vehicles, the cryptocurrency market may experience increased liquidity and reduced volatility. This, in turn, could pave the way for broader acceptance of cryptocurrencies within mainstream finance.

Bitcoin ETFs and Decentralized Finance (DeFi):

While traditional financial markets stand to benefit from the introduction of Bitcoin ETFs, the impact on decentralized finance (DeFi) is a subject of much speculation. DeFi platforms operate on the principles of decentralization, providing users with financial services without the need for traditional intermediaries. The influx of institutional capital through Bitcoin ETFs could potentially challenge the ethos of decentralization that DeFi projects uphold.

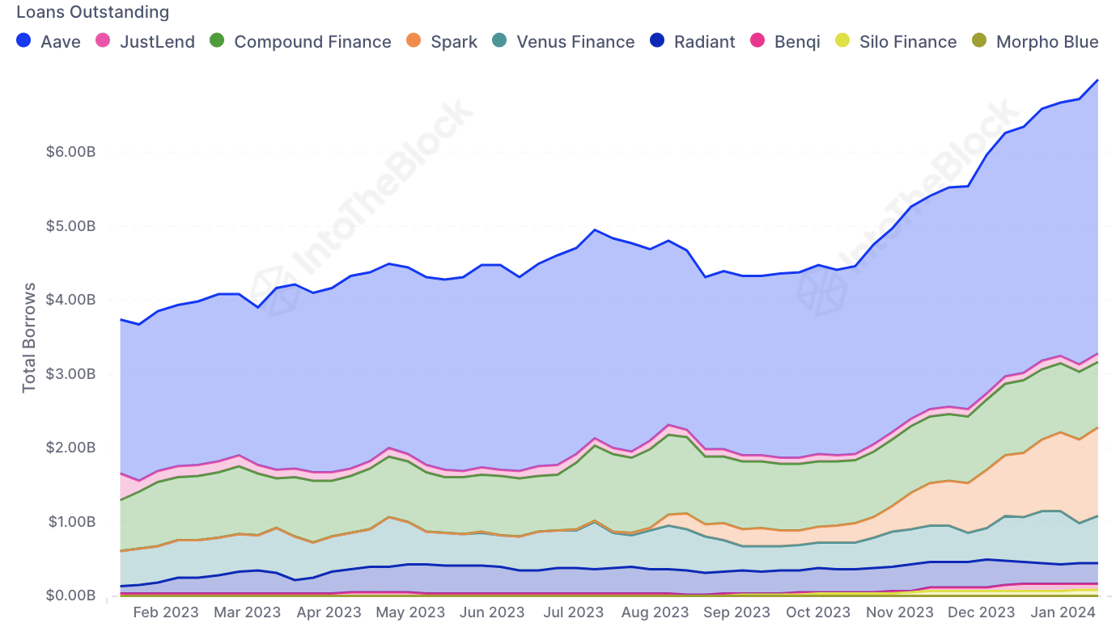

DeFi’s Credit Boom:

The DeFi space has witnessed a remarkable credit boom, with users leveraging their cryptocurrency assets to borrow and lend on various decentralized platforms. The accessibility and efficiency of DeFi lending protocols have attracted a diverse range of participants, from individual retail investors to institutional players. The question arises: How might the growing popularity of Bitcoin ETFs influence this decentralized credit ecosystem?

Competition for Yield:

Bitcoin ETFs may introduce new dynamics to the DeFi lending space, creating a competitive environment for yield. As institutional investors allocate funds to Bitcoin through ETFs, they may seek additional returns by participating in DeFi lending protocols. This increased demand for lending services could potentially drive up interest rates in the DeFi market, benefitting existing participants but also introducing new challenges for risk management.

Collateralization and Risk Management:

The collateralization of loans is a critical aspect of DeFi lending, ensuring that borrowers have sufficient assets to cover their obligations. The integration of Bitcoin ETFs into the DeFi ecosystem introduces new considerations for collateral types and risk management. DeFi protocols may need to adapt to accommodate Bitcoin-backed loans, potentially requiring innovative solutions for assessing and mitigating risk in a market traditionally dominated by Ethereum-based assets.

Regulatory Considerations:

The intersection of Bitcoin ETFs and DeFi raises important regulatory questions. Regulators, both in traditional finance and the cryptocurrency space, may need to address potential challenges arising from the integration of ETFs with decentralized lending platforms. Clear regulatory frameworks will be essential to ensure the stability and integrity of the financial ecosystem as these two worlds converge.

FAQ

Q1: What is the significance of the competition among Bitcoin ETFs? A1: The competition among Bitcoin Exchange-Traded Funds (ETFs) is significant as it provides traditional investors with a regulated and convenient way to gain exposure to Bitcoin’s price movements without directly owning the cryptocurrency. Different ETF providers are vying for market share, offering varied fee structures, custody solutions, and trading mechanisms.

Q2: Who are the key players in the Bitcoin ETF race? A2: Notable players in the Bitcoin ETF race include financial institutions and investment firms such as Grayscale, VanEck, and Purpose Investments. These entities are seeking regulatory approval for their ETFs and are competing to attract investors with unique propositions.

Q3: How might Bitcoin ETFs impact traditional financial markets? A3: The approval and adoption of Bitcoin ETFs could impact traditional financial markets by bringing increased liquidity and potentially reducing volatility to the cryptocurrency market. This, in turn, might pave the way for broader acceptance of cryptocurrencies within mainstream finance.

Q4: What is DeFi, and how does it relate to Bitcoin ETFs? A4: Decentralized Finance (DeFi) refers to financial services and applications built on blockchain technology, operating without traditional intermediaries. The relationship with Bitcoin ETFs lies in the potential impact on DeFi’s ethos of decentralization as institutional investors gain easier access to Bitcoin through regulated investment vehicles.

Q5: What is the credit boom in DeFi, and how does it tie into Bitcoin ETFs? A5: The credit boom in DeFi refers to the surge in borrowing and lending activities on decentralized platforms. With the introduction of Bitcoin ETFs, institutional investors might enter the DeFi lending space, creating competition for yield and potentially driving up interest rates.

Q6: How could Bitcoin ETFs influence the yield in DeFi lending? A6: Bitcoin ETFs could introduce increased demand for DeFi lending services as institutional investors seek additional returns. This may lead to a competitive environment for yield, impacting interest rates in the DeFi market.

Q7: What challenges might arise in DeFi collateralization with the integration of Bitcoin ETFs? A7: The integration of Bitcoin ETFs into the DeFi ecosystem introduces considerations for collateral types and risk management. DeFi protocols may need to adapt to accommodate Bitcoin-backed loans, requiring innovative solutions for assessing and mitigating risk.

Q8: What regulatory considerations come into play with the convergence of Bitcoin ETFs and DeFi? A8: The intersection of Bitcoin ETFs and DeFi raises regulatory questions, both in traditional finance and the cryptocurrency space. Clear regulatory frameworks are essential to ensure stability and integrity as these two worlds converge.

Q9: What does “92cf40232bff” refer to in the context of Bitcoin ETF competition and DeFi’s credit boom? A9: Unfortunately, the provided alphanumeric string “92cf40232bff” is unclear and does not correspond to a known term or concept. Please provide additional information or clarify for a more accurate response.

Q10: How should investors approach the evolving landscape of Bitcoin ETFs and DeFi? A10: Investors should approach the evolving landscape with a nuanced perspective, considering factors such as regulatory developments, risk management strategies, and the potential impact of institutional involvement. Staying informed about market dynamics and being adaptable to changes is crucial in navigating this complex intersection of traditional and decentralized finance.

Conclusion:

The competition among Bitcoin ETFs has far-reaching implications for both traditional and decentralized finance. As these investment vehicles gain widespread acceptance, the delicate balance between innovation and regulation becomes increasingly important. While the credit boom in DeFi presents new opportunities, it also brings challenges that necessitate thoughtful solutions. The evolving landscape of cryptocurrency and finance demands a nuanced approach to navigate the intersection of Bitcoin ETFs and the decentralized credit boom, ensuring a sustainable and resilient financial future.